Upload

xzaxarias1975

View

502

Download

7

Embed Size (px)

DESCRIPTION

Presentation in Powerpoint of M.B.A. Dissertation

Citation preview

HELLENIC OPEN UNIVERSITYSCHOOL OF SOCIAL SCIENCES

M.B.A. THESIS

FINANCIAL STATEMENT ANALYSIS AS A MEANS FINANCIAL STATEMENT ANALYSIS AS A MEANS FOR ASSESSING CORPORATE FOR ASSESSING CORPORATE

CREDITWORTHINESS AND VIABILITYCREDITWORTHINESS AND VIABILITY

ByBy

Christos ZachariasChristos Zacharias

Supervisor: Dr Dimitris PetmezasSupervisor: Dr Dimitris Petmezas

INTRODUCTION

Financial Statement Analysis is the examination of the relations among

various economic elements that are included in the published financial

statements of companies. It facilitates users (i.e. creditors, investors

etc) of them to make sound economic decisions.

Commercial Banks use financial statements to assess the current and

past financial position and performance of companies that apply for

credit and loans, in order to evaluate their capacity to repay debt and

to determine the amount of credit risk involved in a lending situation.

MOTIVATION & OBJECTIVES OF THE STUDY

Recent examples of accounting scandals and bankruptcies (i.e.Enron) have

raised questions about the usefulness and adequacy of financial statements

in helping creditors and investors make sound economic decisions.

In addition, the recent international financial crisis has proved that the

underestimation of credit risk can have devastating consequences for

Financial Institutions (i.e. Lehman Brothers Bankruptcy).

This study attempts to evaluate the adequacy, effectiveness and predictive

ability of financial statement analysis as a means for assessing corporate

creditworthiness and financial viability from the viewpoint of Commercial

Banks as creditors.

METHODOLOGY AND DATA

Part A΄:

Examination of the theoretical framework for credit standing and viability

assessment of enterprises through financial statement analysis, including

presentation of business failure predictions models, by reviewing the

relevant literature.

Part B΄:

Empirical investigation: We assess the credit standing and viability of a

sample of 10 publicly traded Greek companies, which have been manually

collected from A.S.E. More specifically, we make comparative analysis

between 5 financially healthy and 5 financially unhealthy companies of the

same industries, by using a failure prediction model and some financial

ratios.

THEORETICAL FRAMEWORK (1)

Presentation of objectives (according to various points of view) and most

common methods of financial statement analysis:

• Comparative Financial Statement Analysis

• Common - Size Financial Statement Analysis

• Ratio Analysis

• Cash Flow Analysis

THEORETICAL FRAMEWORK (2)

Presentation of the assessment of corporate creditworthiness and financial

viability, from the viewpoint of Commercial Banks, in the general context of

business credit approval process and credit risk evaluation:

I.Business and industry risk assessment

II.Analysis of financial performance and financial ratios

i. Analysis of Liquidity

ii. Analysis of Solvency & Capital Structure

iii.Analysis of Profitability

iv.Analysis of Efficiency

→

THEORETICAL FRAMEWORK (3)

III. Analysis and forecasting of cash flows

IV. Analysis of non-financial indicators (evaluation of quality criteria like

collateral and business character)

V. Credit decision making

THEORETICAL FRAMEWORK (4)

Examination of the use of financial ratios for predictive purposes and review of

the most popular classical statistical business failure prediction models which

are based on financial statements and especially on financial ratios:

Univariate Analysis (W.Beaver)

Multivariate Discriminant Analysis Models (Z-Score and ZETA models)

Conditional Probability Models (Logit and Probit Analysis)

THEORETICAL FRAMEWORK (5)

Presentation of the most important limitations in financial statement analysis

and their consequences on corporate credit analysis:

General Limitations

Historical Cost Principle

Contingent Liabilities

Accounting Risk

Proportionality of Financial Ratios

Creative Accounting

EMPIRICAL INVESTIGATION (1)

Comparative analysis between 5 financially healthy publicly traded companies

and 5 financially unhealthy/ failed ones of the same industries, by using a

failure prediction model (Altman’s Z-score) and 5 financial ratios which are

considered important in corporate credit analysis.

(Companies whose shares were recently suspended were selected as examples of

unhealthy companies. Companies whose shares were not suspended nor were under

observation were selected as examples of non-failed (healthy) companies.)

The selected financial ratios and Z-score are comparatively examined in pairs

of companies that belong to the same sector for testing whether these ratios

and Z-score of failed companies are significantly different to those of non-failed

ones in the years before failure and whether they are good indicators of

corporate creditworthiness and viability.

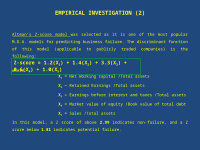

EMPIRICAL INVESTIGATION (2)

Altman’s Z-score model was selected as it is one of the most popular M.D.A. models for

predicting business failure. The discriminant function of this model (applicable to

publicly traded companies) is the following:

where:

X1 = Net Working capital /Total assets

X2 = Retained Earnings /Total assets

X3 = Earnings before interest and taxes /Total assets

X4 = Market value of equity /Book value of total debt

X5 = Sales /Total assets

In this model, a Z score of above 2.99 indicates non-failure, and a Z score below 1.81

indicates potential failure.

Z-score = 1.2(X1) + 1.4(X2) + 3.3(X3) + 0.6(X4) + 1.0(X5)

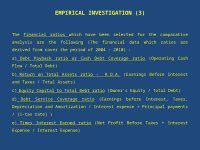

EMPIRICAL INVESTIGATION (3)

The financial ratios which have been selected for the comparative analysis are the

following (The financial data which ratios are derived from cover the period of 2004 –

2010) :

a) Debt Payback ratio or Cash Debt Coverage ratio (Operating Cash Flow / Total

Debt)

b) Return on Total Assets ratio - R.O.A. (Earnings Before Interest and Taxes / Total

Assets)

c) Equity Capital to Total Debt ratio (Owner’s Equity / Total Debt)

d) Debt Service Coverage ratio (Earnings before Interest, Taxes, Depreciation and

Amortization / Interest expense + Principal payments / (1-tax rate) )

e) Times Interest Earned ratio (Net Profit Before Taxes + Interest Expense / Interest

Expense)

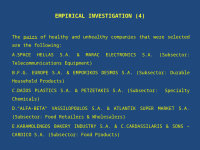

EMPIRICAL INVESTIGATION (4)

The pairs of healthy and unhealthy companies that were selected are the following:

A.SPACE HELLAS S.A. & MARAC ELECTRONICS S.A. (Subsector:

Telecommunications Equipment)

B.F.G. EUROPE S.A. & EMPORIKOS DESMOS S.A. (Subsector: Durable

Household Products)

C.DAIOS PLASTICS S.A. & PETZETAKIS S.A. (Subsector: Specialty Chemicals)

D.“ALFA-BETA" VASSILOPOULOS S.A. & ATLANTIK SUPER MARKET S.A.

(Subsector: Food Retailers & Wholesalers)

E.KARAMOLENGOS BAKERY INDUSTRY S.A. & C.CARDASSILARIS & SONS –

CARDICO S.A. (Subsector: Food Products)

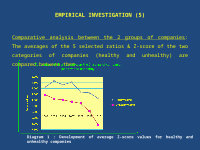

EMPIRICAL INVESTIGATION (5)

Comparative analysis between the 2 groups of companies: The averages of the

5 selected ratios & Z-score of the two categories of companies (healthy and

unhealthy) are compared between them.

Diagram 1 : Development of average Z-score values for healthy and unhealthy companies

EMPIRICAL INVESTIGATION (6)

Diagram 2 : Development of average Debt Payback ratio values for healthy and unhealthy companies

EMPIRICAL INVESTIGATION (7)

Diagram 3 : Development of average ROA ratio values for healthy and unhealthy companies

EMPIRICAL INVESTIGATION (8)

Diagram 4 : Development of average Equity to Debt ratio values for healthy and unhealthy companies

EMPIRICAL INVESTIGATION (9)

Diagram 5 : Development of average Debt Service Coverage ratio values for healthy and unhealthy companies

EMPIRICAL INVESTIGATION (10)

Diagram 6 : Development of average Times Interest Earned ratio values for healthy and unhealthy companies

EMPIRICAL INVESTIGATION (11)

Most Important Findings and Conclusions :

The two groups of companies have significantly different Z-score values, during

all years of the period under consideration.

3 out of 5 ratios of failed companies present significant differences to those of

non-failed ones in four years before failure.

The distinct examination of individual ratios does not lead to clear conclusions

regarding the corporate credit standing and viability.

The joint analysis of some financial ratios which contain common informative

characteristics (i.e. Solvency ratios) can lead to a correct prediction of

companies’ creditworthiness and future financial position.

The overall predictive ability of Z – score model is moderate.

EMPIRICAL INVESTIGATION (12)

Most Important Findings and Conclusions (continuity):

During the last 3 years (2008, 2009 and 2010), of the period under review,

Z-score values, both in company level and on average, are generally very

low, compared with the corresponding values of the previous 4 years.

Therefore, we can conclude that the emergence of unforeseen troubles in

the international and domestic macroeconomic business environment

affects negatively the reliability of Z-score model in terms of correct

classification of companies.

GENERAL CONCLUSIONS

Generally, the analysis of reliable financial statements is fairly effective on the

proper assessment of companies’ creditworthiness and the prediction of their

viability made by Commercial Banks. On the other hand, this analysis is subject

to certain limitations, due to the inherent weaknesses of financial statements,

and cannot provide a complete understanding of the borrowing companies.

Therefore, financial statement analysis is not sufficient, so that to lead by itself

Loan Officers to make final credit decisions. However, it constitutes a very

useful and indispensable tool within the business credit approval process that is

followed by Commercial Banks.

THANK YOU FOR YOUR ATTENTION